IC-DISC EXPORT INCENTIVES

The Internal Revenue Code contains provisions intended to help U.S. companies compete internationally by offering significant Federal income tax savings for export activities. However, many companies are not taking advantage of these rules or are not using them to their full potential. The Interest Charge Domestic International Sales Corporation (IC-DISC) provisions provide significant and permanent tax savings for producers and distributors of U.S. made products used abroad. The IC-DISC also can benefit certain service providers.

BENEFITS

IC-DISC benefits are available to qualified producers or distributors that are either directly involved in exporting or selling products to distributors or wholesalers who resell for use outside of the U.S. This includes traditional manufacturers as well as those who grow agriculture products, extract minerals, distribute U.S. made goods, and develop software. Architectural and engineering services related to foreign construction projects are also included.

HOW DOES IT WORK?

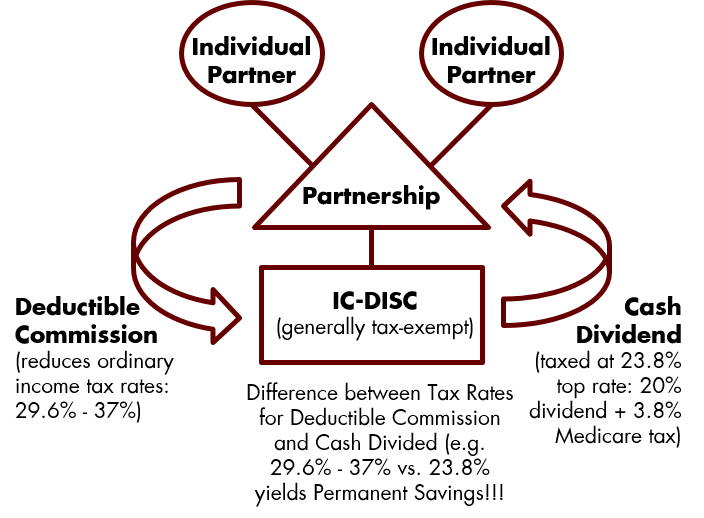

- The owners of the operating company forms a new domestic entity and elects for it to be treated as an IC-DISC, which is tax exempt.

- The IC-DISC maintains its own bank account and accounting records, as well as files Form 1120-IC-DISC.

- The operating company pays a tax deductible commission to the IC-DISC equal to at least the greater of 4% of operating company’s gross receipts from qualified exports or 50% of the operating company’s net income from qualified exports. Otherwise, the operating company’s business operations are unchanged.

- The operating company expenses the commission and reduces ordinary income generally taxed at a 29.6% or a 37% rate.

- Since the IC-DISC is tax exempt, it is not taxed on the commission income it receives from the operating company.

- The IC-DISC pays dividends to its shareholders, which are taxed at a 23.8% top rate (20% dividend rate plus 3.8% Medicare tax).

- Due to the tax rate arbitrage between ordinary income tax and dividend rates, the IC-DISC provides permanent tax savings.

Below is a typical structure for a partnership or other flow-through entity.